Venture Investing: How to Differentiate Your Portfolio | SmartPairing Ventures

Why Most Portfolios Look the Same — And Where Real Growth May Come From

Most investment portfolios today end up looking the same. Whether you work with a financial advisor or manage your own money, the default is usually some version of a 70/30 stock/bond split. On paper that looks diversified—until you look closer. Much of the equity side is concentrated in the same mega-cap names.

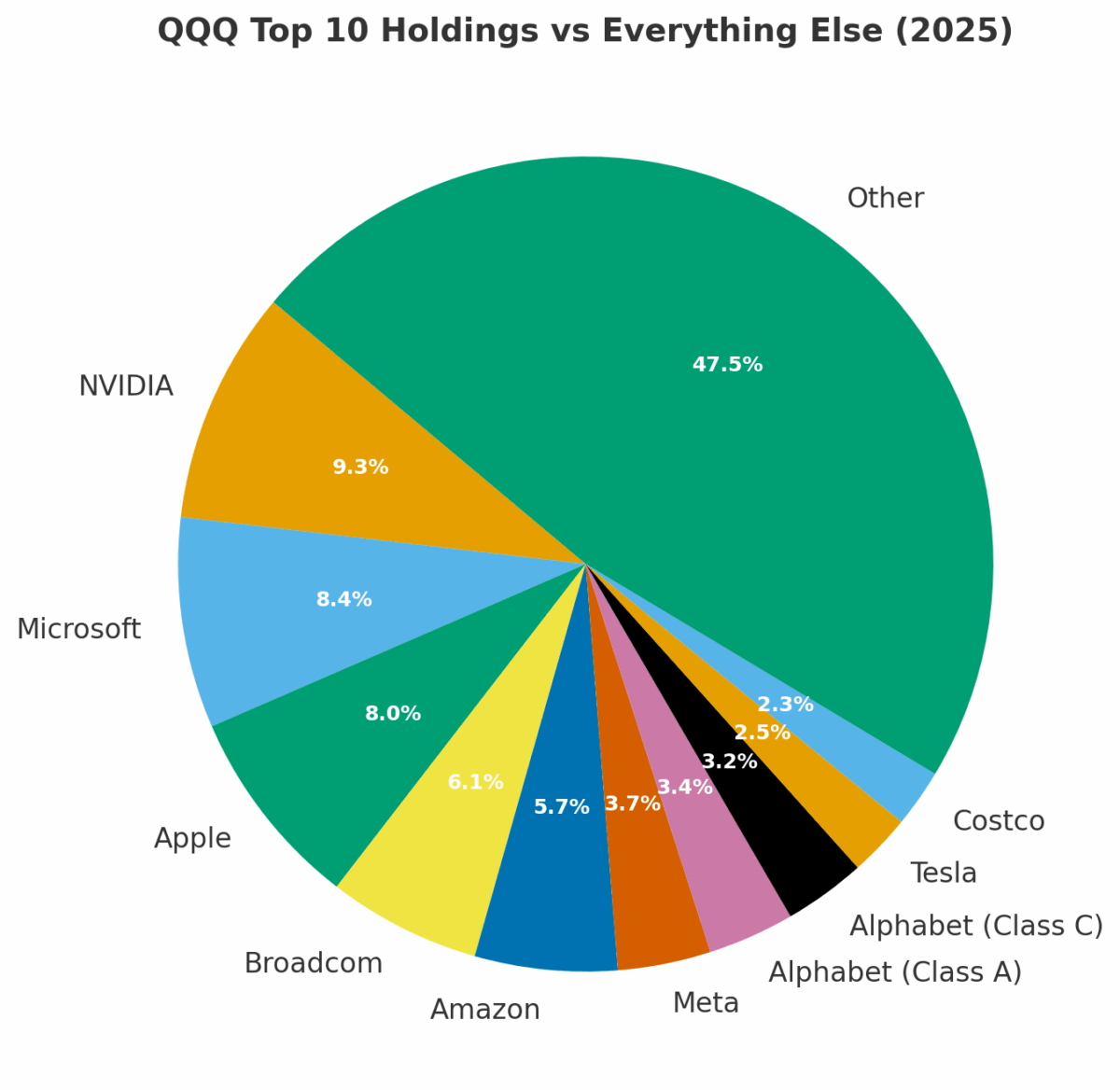

Let’s see how that looks with the Invesco QQQ Trust, one of the largest, most popular ETFs in market.

QQQ Concentration

Even portfolios that look diversified often rely heavily on just a handful of stocks. In QQQ, the top 10 holdings control about 52.8% of the fund. A small group of mega-cap names dominate performance. If you hold a 1% position in something outside these giants—even if it doubles—it barely moves your overall portfolio.

- Source: Invesco Fund Page

Top 10 vs. Bottom 90: Where Performance Really Comes From

As of early September 2025, QQQ’s top 10 holdings total ~52.8% of the fund (NVDA 9.39%, MSFT 8.35%, AAPL 7.89%, AVGO 5.90%, AMZN 5.70%, META 3.75%, GOOGL 3.14%, NFLX 2.98%, GOOG 2.95%, TSLA 2.85%). In practice, that means a bit over half of QQQ’s return is typically driven by those top 10 names, while the other ~90 positions share the remaining ~47% of weight. Day-to-day attribution varies, but the weight split is the best quick proxy for where performance is concentrated.

Private Market Examples

This is why real growth often happens outside the consensus. In fact, many of today’s fastest-growing opportunities remain private—well before they appear in public ETFs.

Figure AI (robotics): In February 2024, it raised $675M at a ~$2.6B valuation. By 2025, reports showed it discussing a $1.5B round at ~$39.5B—a roughly 15× jump in about a year. As a result, early private investors captured value that index funds will never reflect.

OpenAI (AI): Meanwhile, reports suggest private valuations as high as $500B tied to fundraising and employee share sales.

Anthropic (AI): Additionally, In September 2025, raised $13B at a post-money valuation of $183B.

SpaceX (space/AI-enabled autonomy): And at the same time, SpaceX surged past $210B in private valuation, fueled by Starlink’s global expansion and its dominance in launch services.

Bottom line: Together, these companies capture a disproportionate share of future growth long before most investors can reach them. Therefore, even a modest 10% allocation to vetted venture opportunities can meaningfully differentiate a portfolio that would otherwise mirror the crowd.

Family Office Allocations

Family offices already know this: differentiated exposure matters. While they often allocate 20–30% to venture and private equity, the average investor doesn’t need to go that far. Even shifting just 10% toward alternatives—though not without risk—can make a real difference. And importantly, investors can often build that exposure through a retirement account.

- Family offices now allocate 20–30% of assets to private equity and venture.

- Alternatives (PE, venture, private real estate, infrastructure) can account for 40%+ of their portfolios.

Looking Ahead

We all know what’s coming: the next wave of investing will be driven by tech, AI, robotics, automation, and frontier innovation. Early-stage deals often deliver some of the highest upside. At the same time, they can help reduce portfolio volatility because they do not move in lockstep with the public market consensus.

The question is whether your portfolio will continue to mirror the consensus—or whether it will be positioned to capture what’s next. That is why family offices already allocate heavily to alternatives. Likewise, more advisors and retail investors are beginning to explore how even a modest allocation can provide meaningful differentiation.

At SmartPairing Ventures, we make that transition possible. Through digital onboarding, transparent structures, and the ability to participate with retirement accounts, investors gain access to high-conviction private deals. This approach offers a practical way to complement a traditional portfolio and add exposure to the innovations most likely to define the next decade.

Sources

• QQQ top holdings and weights: StockAnalysis ETF Holdings

• Figure AI funding and valuation jump: TechFundingNews

• OpenAI valuation: CNBC

• Anthropic valuation: Reuters

• SpaceX valuation: Bloomberg

• Family office allocations: EQT Group / UBS Global Family Office Report 2025

Disclaimer: This content is provided for informational purposes only and should not be considered investment advice or a recommendation to buy or sell any security. Private investments involve risk, including the potential loss of principal, and are generally illiquid. Past performance is not indicative of future results. Investors should consult their own financial, tax, and legal advisors before making any investment decisions. SmartPairing Ventures does not provide personalized investment advice through this publication.